We are thinking about administrative or a cost account, something that comes up often is the thought of manufacturing cost management. When you consider manufacturing costs, you ought to be wary because you will use them while computing. the cost of goods sold (COGS). Thus, you should have a crucial comprehension of what manufacturing costs are.

Manufacturing cost in its components

Manufacturing costs can be characterized as a portrayal of just the costs caused in making an item and along these lines do exclude things like authoritative costs.

In accounting, it envelops a few undertakings that impact every unit of creation and stock valuation. As characterized, the manufacturing cost control has three significant components:

- Direct material

- Direct work

- Manufacturing overhead

Considering a manufacturing organization that makes vehicles, these components can be characterized as:

Direct materials–These are the crude materials that go straightforwardly into a result. Say the manufacturing organization makes a vehicle body from steel; the manufacturing overhead incorporates steel and other related materials.

Direct work- This incorporates work that can be followed to singular units delivered. Consider a vehicle falling off a mechanical production system; you can say that a particular individual amassed that vehicle, Consequently, the immediate work cost incorporates the work they did, like amassing an entryway.

Manufacturing overhead–All manufacturing costs that are not immediate work or direct materials are overhead. The janitor in a vehicle mechanical production system is aberrant work. For roundabout materials, they incorporate every one of the materials used to assemble the immediate materials underway. For instance, a silicone stick is used to assemble a rearview reflects.

Production Costs versus Manufacturing Costs

Production costs mirror the total expense of the cost related to an organization directing its business while manufacturing costs address just the costs important to make the item.

Both of these figures are used to assess the all-out costs of working in a manufacturing business management. The income that an organization creates should surpass the absolute cost before it accomplishes productivity.

Here are six different ways you can handle manufacturing cost management using insight arrangements:

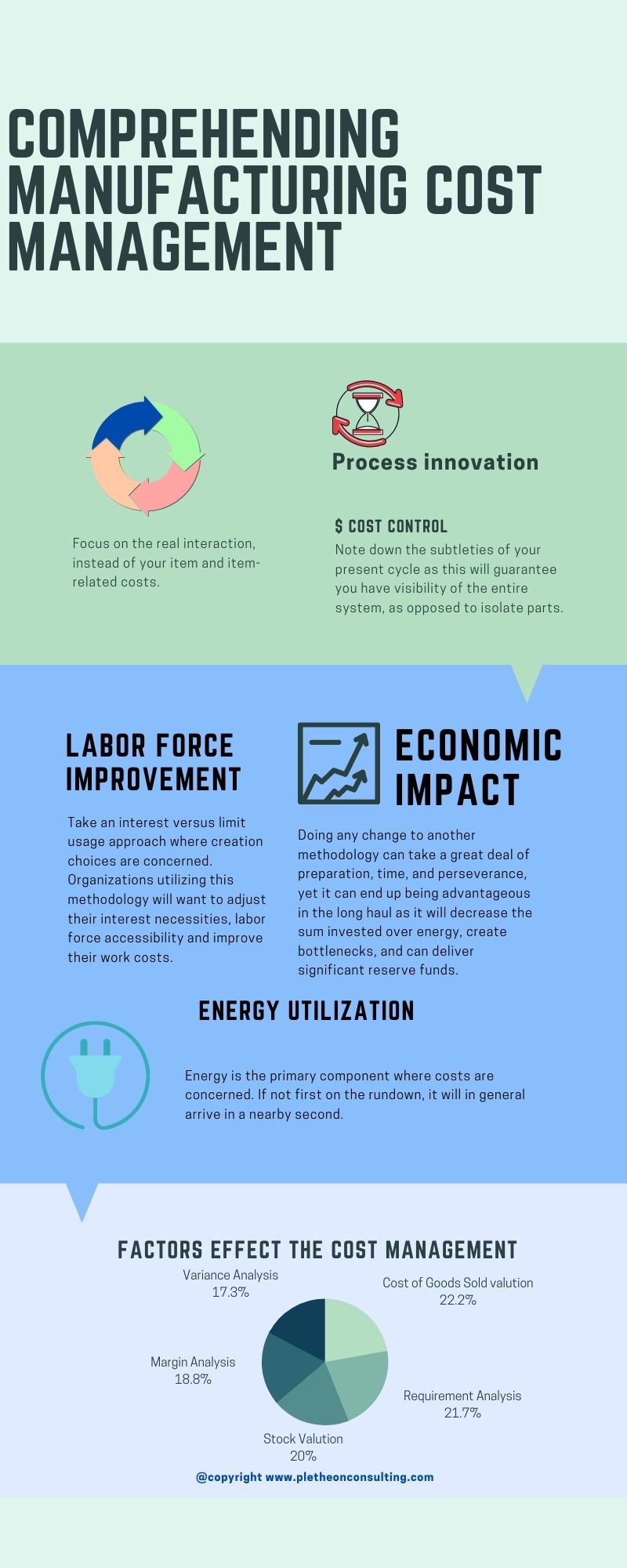

Process innovation

Focus on the real interaction, instead of your item and item-related costs. Note down the subtleties of your present cycle as this will guarantee you have visibility of the entire system, as opposed to isolate parts. It will help stay away from fractional process innovation and the improvement of one part of the cycle to the detriment of another.

Labor force improvement

Take an interest versus limit usage approach where creation choices are concerned. Organizations utilizing this methodology will want to adjust their interest necessities, labor force accessibility and improve their work costs. Doing any change to another methodology can take a great deal of preparation, time, and perseverance, yet it can end up being advantageous in the long haul as it will decrease the sum invested over energy, create bottlenecks, and can deliver significant reserve funds.

Energy utilization

Energy is the primary component where costs are concerned. If not first on the rundown, it will in general arrive in a nearby second. Guarantee you settle on request-driven choices, which will empower your variety of things to take care of more slowly, save energy, and do as such without the need to forfeit yield or client support. Precise visibility of your working conditions continuously is pivotal.

Looking after quality

Item quality issues can be costly. Putting resources into a business framework that can deal with all warehousing, manufacturing interaction, quality, and client assistance needs will give you quality business insight. Better insight can prompt improved underlying driver examination and the exact observation of item deformity levels. The information assembled can likewise feature issues and shortcomings inside measures. Along these lines, an incorporated framework will permit proactive management of value all through the entire manufacturing firm.

Lower the cost of consistency

The more continuous visibility and improved quality you have, the more outlandish you are to run into issues with consistency. If you stay away from the problems which will come up in the future you can save a lot of time and energy.

Stock conveying costs

Stock keeping is a cost and can be costly if there’s a lot of it and if it’s put away for significant periods, so it is essential for makers to calculate capacity as a cost. Responsive and deft manufacturing activity will help stay away from overproduction and limit stockpiling prerequisites. Adjust your creation exercises with your client’s interest, which will guarantee adequate stock levels, and try not to have inordinate stock that you can’t move.

When we comprehend the real manufacturing cost management the time has come to think about the approaches to lower it to increase the overall revenues.

We should initially comprehend What Is a Manufacturing Cost Controller for manufacturing cost management?

A manufacturing cost controller is a system or individual liable for dissecting and overseeing manufacturing cost management.

This interaction involves a progression of materials and a gathering of costs. Manufacturing costs management incorporates overheads, compensations, work costs, the cost of materials or crude materials, deals cost, and general regulatory cost. Cost control, otherwise called cost management, worries about the control of the progression of costs.

What are the goals of the cost controller?

Manufacturing cost controller of various manufacturing firms may fluctuate in their goals, yet their essential focus stays comparable: They oversee and control costs of all manufacturing, material, and work costs; lead execution management and help in the general arranging measure; help set costs for work and material; and decide stock valuation.

Information required for manufacturing cost management

Cost regulators require fundamental information about key costing, bookkeeping, planning, and management bookkeeping standards.

Practices and Tools for manufacturing cost management

Processes and practices like total cost of ownership (TCO) and target cost management (TCM) are utilized to control manufacturing costs management. TCO is a cost control work on manufacturing organizations use to recognize all manufacturing hardware-related costs, like establishment, obtaining, upkeep, tasks, and end-of-life management.

TCM estimates manufacturing execution to check whether manufacturing costs are inside targets. If manufacturing costs are higher than target costs, a medicinal move is made. Other than these practices, various cost control apparatuses and programming bundles are accessible that assist with controlling manufacturing costs

Manufacturing and Budget Cost Control

A manufacturing cost controller evaluates and guarantees that the general manufacturing measure addresses the issues of the firm. The job of a manufacturing cost regulator is like that of budgetary control- – in which real costs brought about by an association are contrasted and dispensed assets. The general venture plan, including cost and time gauges, is overhauled dependent on the contrast between real costs and dispensed assets.

The fundamental contrast between the job of manufacturing and spending cost regulators is that manufacturing regulators commonly require more extensive information on items, manufacturing cycles, instruments and hardware, and the general association.

It’s Significance

Manufacturing cost controller helps improve manufacturing and item quality and representative execution and helps accomplish hierarchical goals. Regulators measure genuine execution against target costs, benefits, and creations and decide if they are being accomplished. Manufacturing cost control is likewise useful in proficiently utilizing restricted assets in the serious manufacturing climate.

This makes a need for manufacturing cost accounting. We should discuss it further.

Manufacturing cost accounting includes zones that sway production tasks and the valuation of the stock. These exercises can essentially support the benefits of a business, just as carry it into consistency with the material bookkeeping norms. The cost accounting is liable for manufacturing bookkeeping exercises.

Coming up next are for the most part components of manufacturing cost bookkeeping. The most basic is the imperative examination since appropriate management of an organization’s limitation is the main driver of its benefit.

Stock Valuation

This is the completely stacked cost of stock toward the finish of a bookkeeping period, which is needed under different bookkeeping norms to put the right valuation on the stock. It is of little use in the everyday tasks of the manufacturing region. In any case, cost bookkeepers invest a lot of energy around here, since an organization’s outer inspectors can be relied upon to invest a lot of time checking on stock cost records. There are various approaches to relegate a valuation to stock, like the standard cost, FIFO, and LIFO strategies.

Cost of Goods Sold Valuation

This is firmly identified with stock valuation. It is feasible to follow the cost of explicit creation occupations (work costing), or overall for all units delivered (measure costing). This cost following can be at the degree of simply those costs that shift with changes in income (direct costing), or it can incorporate a full allotment of production line overhead costs (assimilation costing).

Requirement Analysis

This includes discovering the bottleneck in the manufacturing cycle (assuming any) and prompting the creation division in regards to the effect on the throughput of changes to the progression of work through that bottleneck. The investigation can incorporate an assessment of the stock cradle before the imperative and the presence of any upstream run limit. This can be among the main elements of manufacturing cost bookkeeping.

Margin analysis

This includes the arrangement of all costs related to an item and taking away them from item incomes to show up at the edge of every item. Edge investigation can likewise be applied to conveyance channels, specialty units, clients, and product offerings.

Variance Analysis

This is the correlation of real costs brought about to standard or planned costs and investigating the purposes behind any changes. This part of manufacturing cost bookkeeping may not be fundamental, since the pattern financial plan or standard cost might be flawed. Subsequently, an ideal change may just imply that a standard was set to be so natural to accomplish that all fluctuations from it will undoubtedly be ideal.

Conclusion

Taking everything into account, manufacturing project cost management frameworks are viewed as an important resource for manufacturing offices. The precision they furnish little and enormous associations with the observing of stock, items delivered, items sold, and detailing highlights, they have a huge impact on an organization’s general achievement.